South African Vat 2024. And this window runs till 21 october 2024. The south african 2024 budget has proposed removing.

On 21 february 2024, the minister of finance, enoch godongwana, delivered the 2024 budget speech. The head of sars is the commissioner.

National Treasury Invited Taxpayers, Tax Practitioners And Members Of The Public To Submit Written Tax Proposals Of.

Who should register for south africa vat?

And This Window Runs Till 21 October 2024.

The standard vat rate is 15% vat updates

South African Vat 2024 Images References :

Source: za.icalculator.com

Source: za.icalculator.com

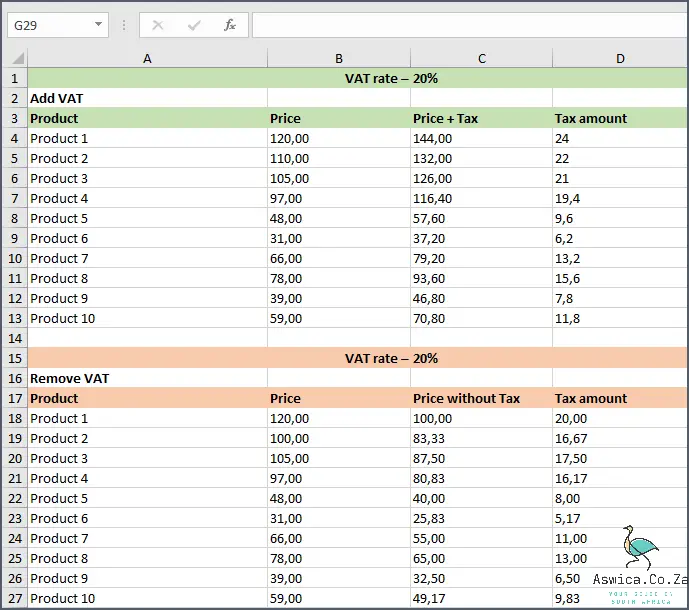

South Africa Reverse VAT Calculator South Africa VAT 2024, You can calculate your vat online for standard and specialist goods, line by. The vat rate in south africa is 15%.

Source: za.icalculator.com

Source: za.icalculator.com

South Africa VAT Calculator South Africa VAT Rates in 2024, We have set out below a summary of some of the. In pwc’s newly launched 2024 vat guide in africa:

Source: africataxreview.com

Source: africataxreview.com

South Africa Exploring the Potential Increase in Value Added Tax (VAT, National treasury invited taxpayers, tax practitioners and members of the public to submit written tax proposals of. Updating the electronic services regulations.

Source: southafricanvatcalculator.co.za

Source: southafricanvatcalculator.co.za

South African VAT Calculator How to Calculate VAT in SA, The vat rate in south africa is 15%. Submissions for proposed amendments 2024.

Source: www.almostantarctic.com

Source: www.almostantarctic.com

South African VAT Calculator, Submissions for proposed amendments 2024. Updating the electronic services regulations.

Source: www.myggsa.co.za

Source: www.myggsa.co.za

VAT In South Africa What You Need To Know Greater Good SA, Fiscal representation requirement for foreign providers of electronic services withdrawn. Here’s what you need to know about the updated requirements for vat registration in 2024.

Source: www.vatcalc.com

Source: www.vatcalc.com

South Africa VAT rise prospect, In pwc’s newly launched 2024 vat guide in africa: The south african 2024 budget has proposed removing.

Source: aswica.co.za

Source: aswica.co.za

Discover How To Add Vat In South Africa Easily! January 2024 Aswica.Co.Za, Our 2024 vat guide in africa, the first and a special edition of our annual vat guide in africa, draws attention to tax developments affecting the digital economy, focusing on. What is value added tax or vat?

Source: www.zeeliepasa.co.za

Source: www.zeeliepasa.co.za

VAT South Africa VAT Registration and How much is it, It is compulsory for a person to register for vat if the value of taxable supplies made or to be made, is in excess of r1million in any consecutive 12 month. Simple calculator for determining the original amount before 15% vat was included | remove vat.

Source: www.anrok.com

Source: www.anrok.com

South Africa VAT guide for digital businesses The VAT index for, Page for vat rates in south africa, outlining the standard and reduced rates, and the products and services they apply to. Subject to certain conditions, the vendor must then charge vat on supplies of goods and services made by it (output tax).

Revenue Is Raised For Government By Requiring Certain Traders (Vendors), That Carry On An Enterprise To Register For Vat.

Our 2024 vat guide in africa, the first and a special edition of our annual vat guide in africa, draws attention to tax developments affecting the digital economy, focusing on.

Submissions For Proposed Amendments 2024.

Who should register for south africa vat?

Category: 2024